Products

Financial Wellness Score

Credit Gateway Financial Services has created a financial service platform for you to

measure your financial health, identify the areas where you need

help and seamlessly access the product or service to improve it.

Many consumers are struggling financially and need help before

and beyond retirement, with 51 percent of people saying they are

just breaking even or spending more than they earn each month.

As a result, 88 percent of Credit Gateway Financial Services clients have adopted its

Financial Wellness solution, which helps consumers focus on their

day-to-day financial status and prioritize the steps needed to

improve their situation.

The Platform is based on what we believe are the four key areas of

Financial Wellness: budget, debt, savings and cover, all of which

are equally significant.

We believe Financial

Wellness means being

well and feeling well

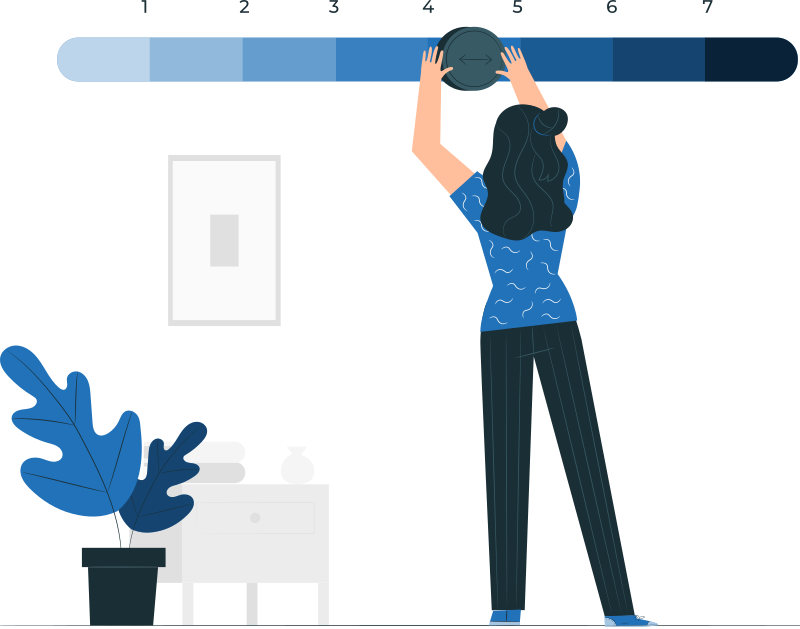

How the score is calculated

The Financial Wellness Score is based

on a scale from 0 to 100, where 0 represents extreme financial

distress and 100 indicates the maximum level of financial

wellness.

To assess how financially well you are today, Credit Gateway Financial Services shows

you your current financial data, don’t worry we are a registered

Credit Bureau with the NCR, and assess how you are doing and

feeling in each area of financial wellness. Credit Gateway Financial Services then

monitors your behaviour within each financial wellness area,

example: Performance on your retirement plan including savings

rate, loan history, adverse credit ratings, credit score history

performance, debt to income ratio performance.

Credit Gateway Financial Services will also you show you what your financial future

will look like, this is critical for you to make proactive decision in

order to prevent potential pitfalls.

Applying the Financial Wellness Score, the results

"excellent" (a score between 81 and 100), "good" (a score between

61 and 80), "fair" (a score between 41 and 60) and "need attention"

(a score between 0 and 40).